is interest paid on new car loan tax deductible

You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax deductible. The taxpayer borrows 50000 secured by his home to be used in his consulting business.

Printable Loan Payment Schedule Template Schedule Template Loan Payoff Student Loan Payment

So if your truck will be driven for both business and personal use you must carefully document the percentage of time the vehicle is used for each purpose.

. Which loans are tax deductible. If you have a vehicle thats used partly for business and partly for personal use the interest is deducted as the percentage that the car is used in your business. Ad Driving an electric car now comes with added benefits for driving a clean car.

You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. Check For The Latest Updates And Resources Throughout The Tax Season. However for commercial car vehicle and equipment loans the interest is a tax deduction.

The taxpayer must allocate interest expense on the loan between rental interest and personal interest for the purchase of the car and even though the loan is secured by the business property the personal loan interest portion is not deductible. Ad Discover Helpful Information And Resources On Taxes From AARP. Remember you can only deduct the business-use percentage of your car.

A Brief History Of. The tax deductions can lower your interest rates. You would also have to claim actual vehicle expenses rather than the standard mileage rate for your vehicle expenses.

Since the payments made to repay a loan can be counted as business expenses they are tax deductible. For how many years can I claim a deduction under section 80EEB. So if you use your car for work 70 of the time you can write off 70 of your vehicle interest.

But you can deduct these costs from your income tax if its a business car. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes. But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file.

Why interest payment on debt is tax deductible. The amount you can deduct will depend on. It can also be a vehicle you use for both personal and business purposes but you need to account for the usage.

The interest on a personal loan normally is not tax-deductible because the Internal Revenue Service treats such interest as personal interest. The taxpayer must allocate interest expense on the loan between rental interest and personal interest for the purchase of the car and even though the loan is secured by the business property the personal loan interest portion is not deductible. Ideally you should make loan repayments from your business income.

However if the vehicle was used for a business purpose you may be able to deduct some or all of the cost against your self-employment income. Types of interest not deductible include personal interest such as. The tax deduction is only available for the interest component of the loan and not for the principal amount.

Here are some of the tax incentives you can expect if you own an EV car. Pictures of Classic Ford Pickup Trucks. However it is possible for taxpayers who meet certain criteria.

Interest paid on car loans for personal vehicles is not tax deductible. Commercial Car Loan Is Tax-Deductible. Interest paid on personal loans is not tax-deductibleIf you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not reduce your tax.

This reduces your net tax obligation at the end of the year. On a chattel mortgage like a property mortgage youre listed as the cars owner allowing you to claim the car loan on your tax return. Note that 750000 is the total new limit.

When you take out car finance to purchase a vehicle for use in your. Credit card and installment interest incurred for personal expenses. The taxpayer borrows 50000 secured by his home to be used in his consulting business.

2200 the total interest she paid in her 2021 fiscal period. For regular taxpayers deducting car loan interest is not allowed. You can write off a part of your car loan interest if you bought a car for personal use but ALSO use it for business purposes.

Heathers available interest is the lesser of the following amounts. When you finance a new vehicle that you intend to use for work you cant deduct the entire monthly bill from your taxes. If you meet the conditions then interest is deductible on a loan of up to 750000 375000 or more for a married taxpayer filing a separate return.

The taxpayer must allocate interest expense on the loan between rental interest and personal interest for the purchase of the car and even though the loan is secured by the business property the personal loan interest portion is not deductible. History of the 60L Power Stroke Diesel Engine. Is car loan interest tax deductible.

Is interest on your car loan tax deductible. Interest on vehicle loans is not deductible in and of itself. Then when filing your taxes you may deduct a percentage of the interest associated with the percentage of time the vehicle was.

You can deduct the interest paid on an auto loan as a business expense using one of two methods. When car loan interest is deductible. The answer to is car loan interest tax deductible is normally no.

Interest paid on a loan to purchase a car for personal use. However if you are buying a car for commercial use you can show the interest paid in a year as an expense and reduce your taxable income. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

She borrowed money to buy the vehicle and the interest she paid in her 2021 fiscal period was 2200. The expense method or the standard mileage deduction when you file your taxes. Is car loan interest tax-deductible.

Since the car that Heather bought is a passenger vehicle there is a limit on the interest she can deduct. However you can write off part of your car loan interest. Its good form to keep track of all business use for your car so you can accurately report it.

No one can only claim a deduction us 80EEB on the interest payment of the loan. An individual can claim a deduction under this section until the repayment of the loan.

Car Donations Tip 1 Donate Car Cars For Sale Car

Quickstudy Finance Laminated Reference Guide Small Business Tax Tax Prep Checklist Tax Prep

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Happy With New Car Car Loans Car Finance Refinance Car

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage Interest Mortgage Interest Property Tax Tax Deductions

Car Loan Tax Benefits And How To Claim It

Is Car Loan Interest Tax Deductible In Canada

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

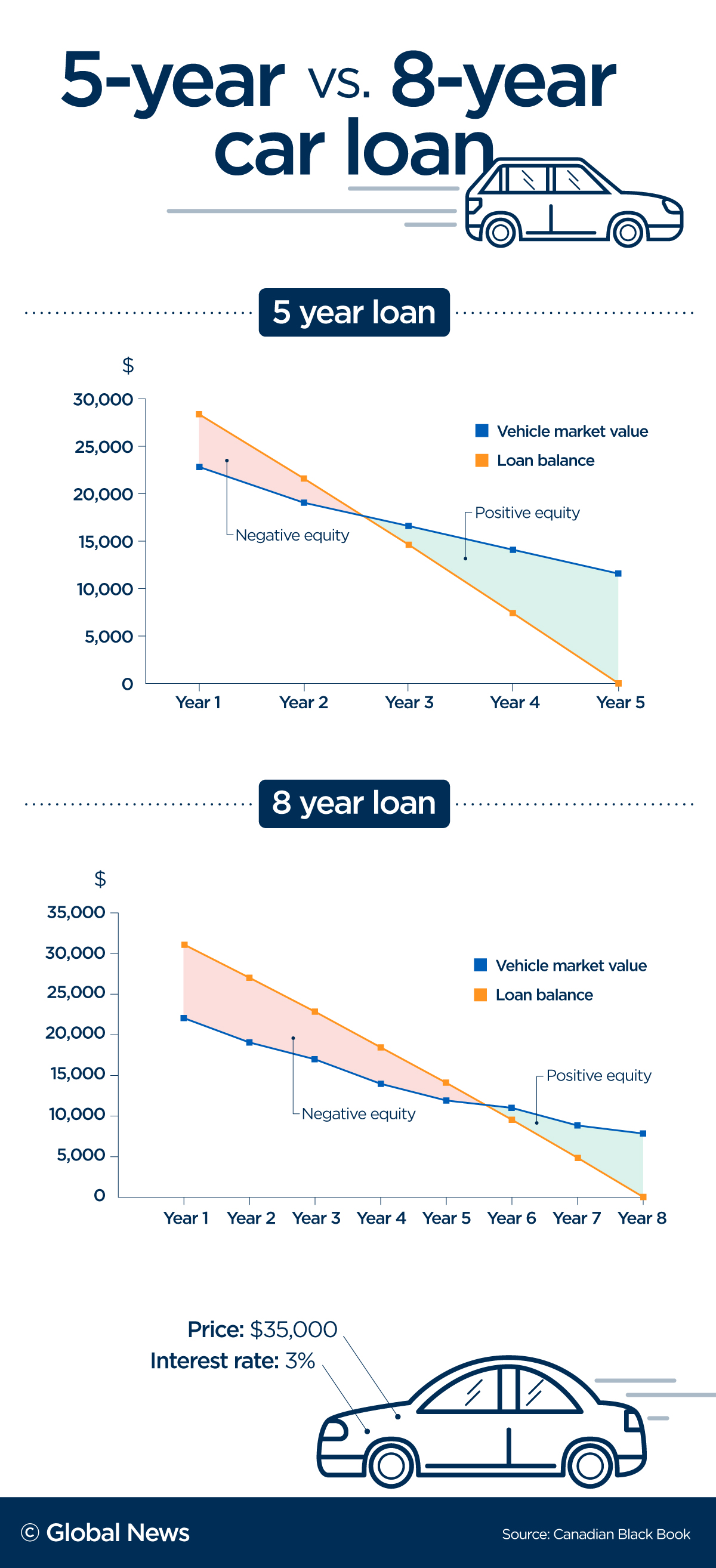

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

How Does Car Loan Interest Work Bmo

Car Loan Tax Benefits On Car Loan How To Claim Youtube

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice